child tax portal phone number

Web The number to try is 1-800-829-1040. Already claiming Child Tax.

Child Tax Credit Portal Now Open For Non Filers How To Claim Up To 3 600 The Us Sun

You can see your advance payments total in.

. The toll-free number for the IRS is 800-829-1040 and representatives are available 7 am. Including PIN requests setting up an online account filing a return on the Portal or making a Portal payment. To get started you can call 800-829.

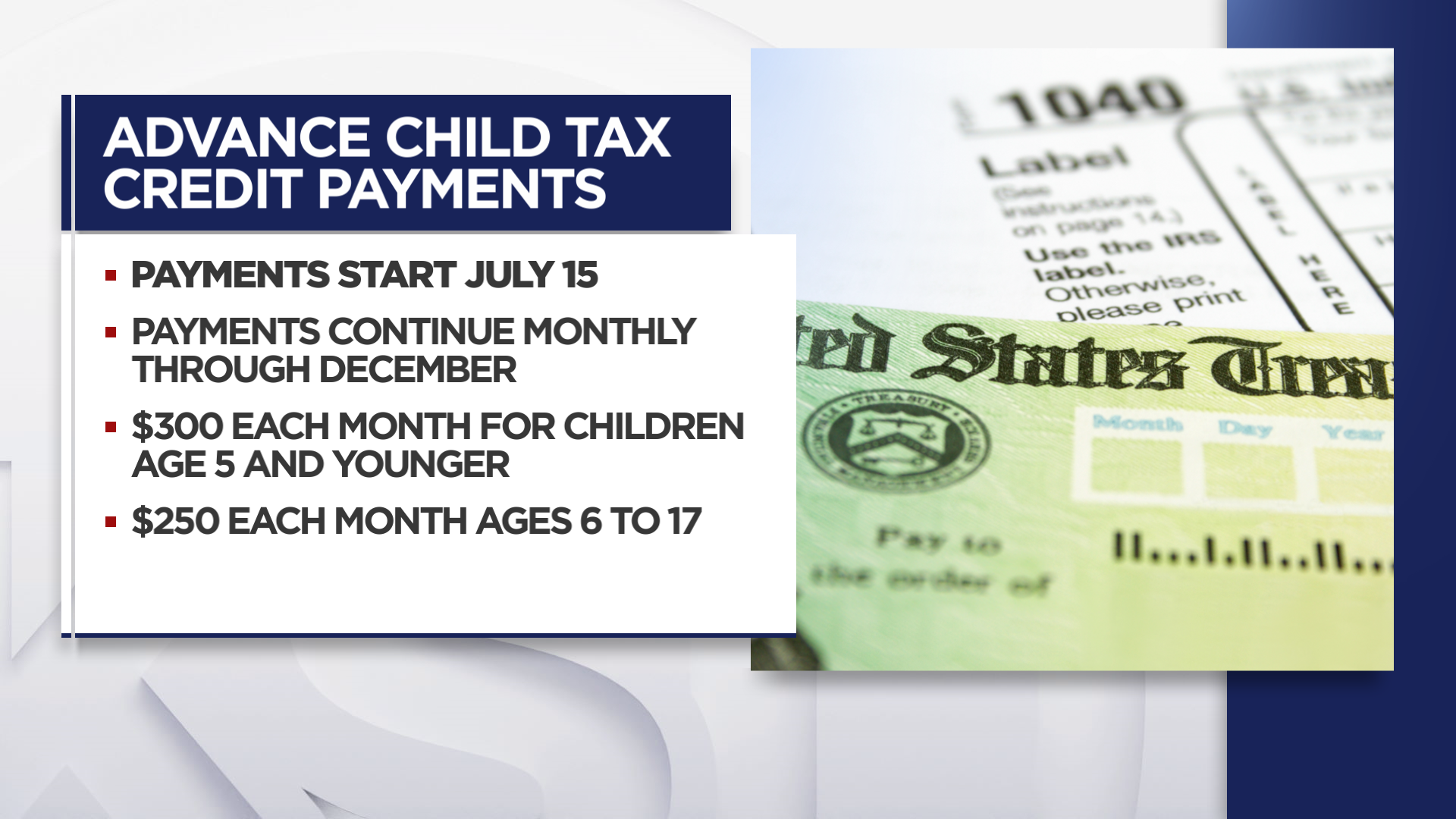

Web The Child Tax Credit provides money to support American families. 15 but the millions of payments the IRS has sent out. The amount you can get depends on how many children youve got and whether youre.

Web What youll get. Web The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept. Web Taxation Self-Service Portal Help.

Web To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Web Many families received advance payments of the Child Tax Credit in 2021. Making a new claim for Child Tax Credit.

Make sure you have the following. Web For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line arent going to have them. Before calling just a warning the.

Web The IRS says you may be waiting on hold for an average of 13 minutes and that wait times are higher on Monday and Tuesday. Web The main IRS phone number is 800-829-1040 but this list of other IRS numbers could help you skip the line spend less time on hold or contact a human faster. Web To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment.

Here is some important information to understand about this years Child Tax Credit. Five Myths About Federal Tax Returns Debunked. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming.

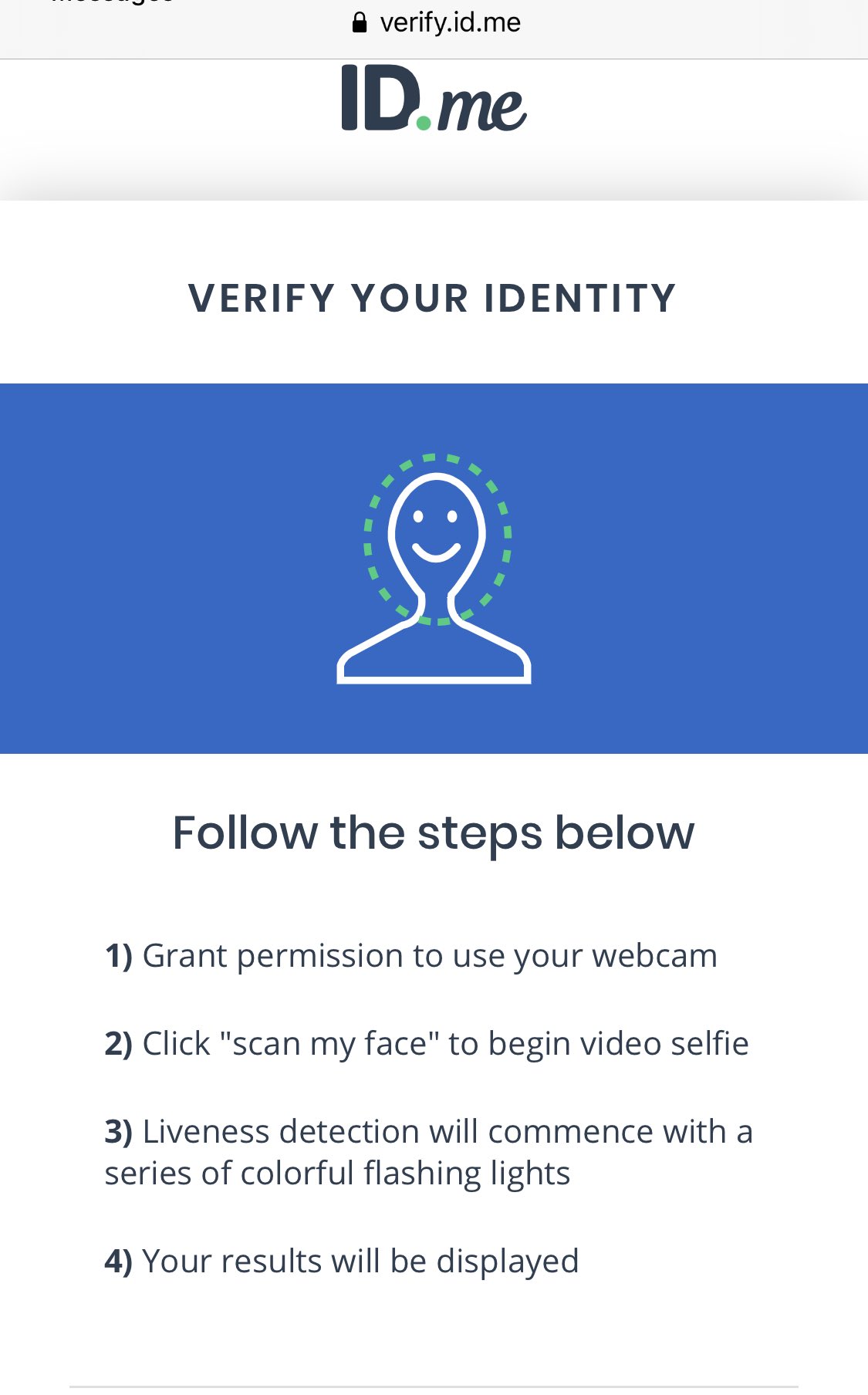

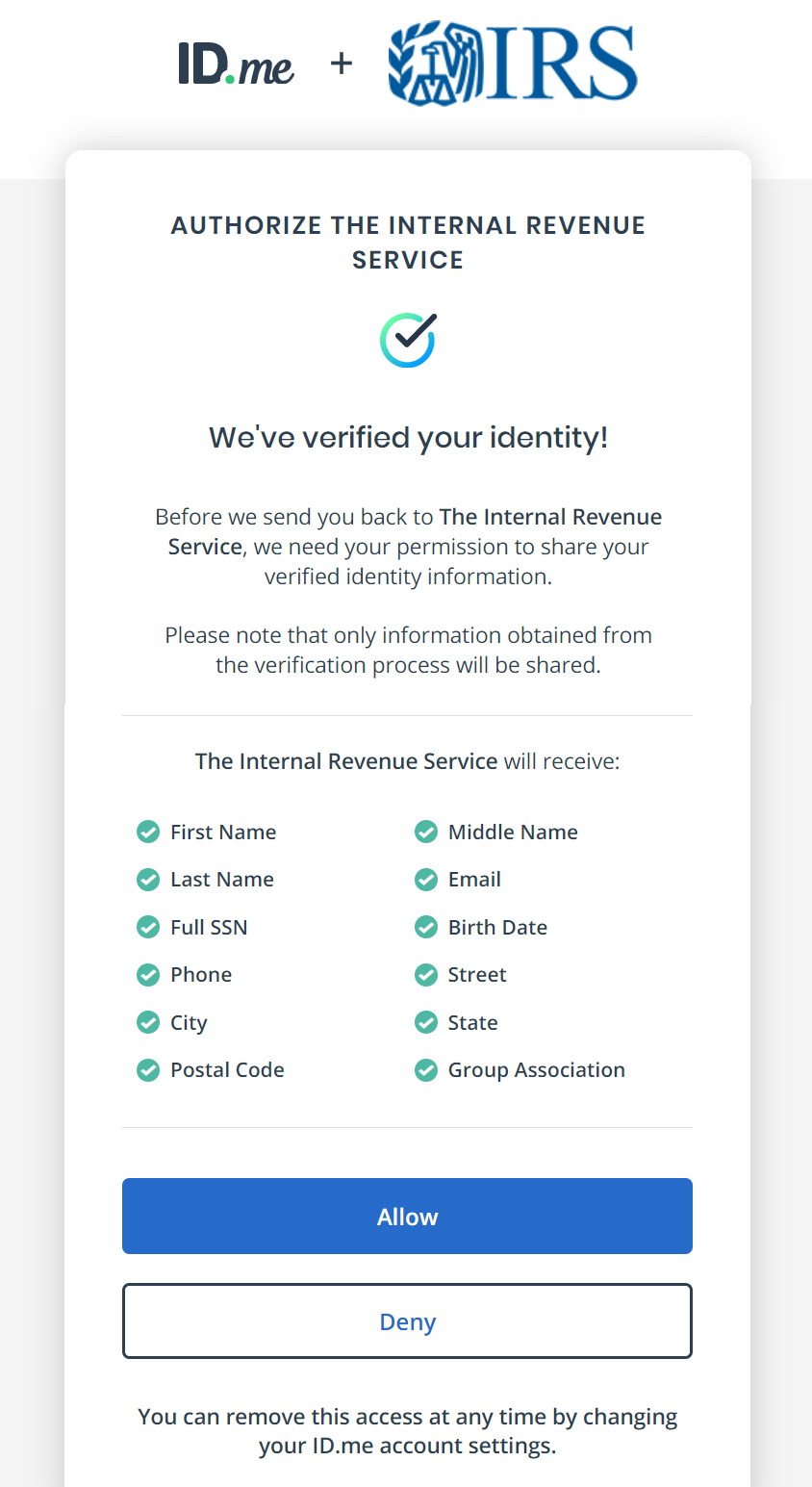

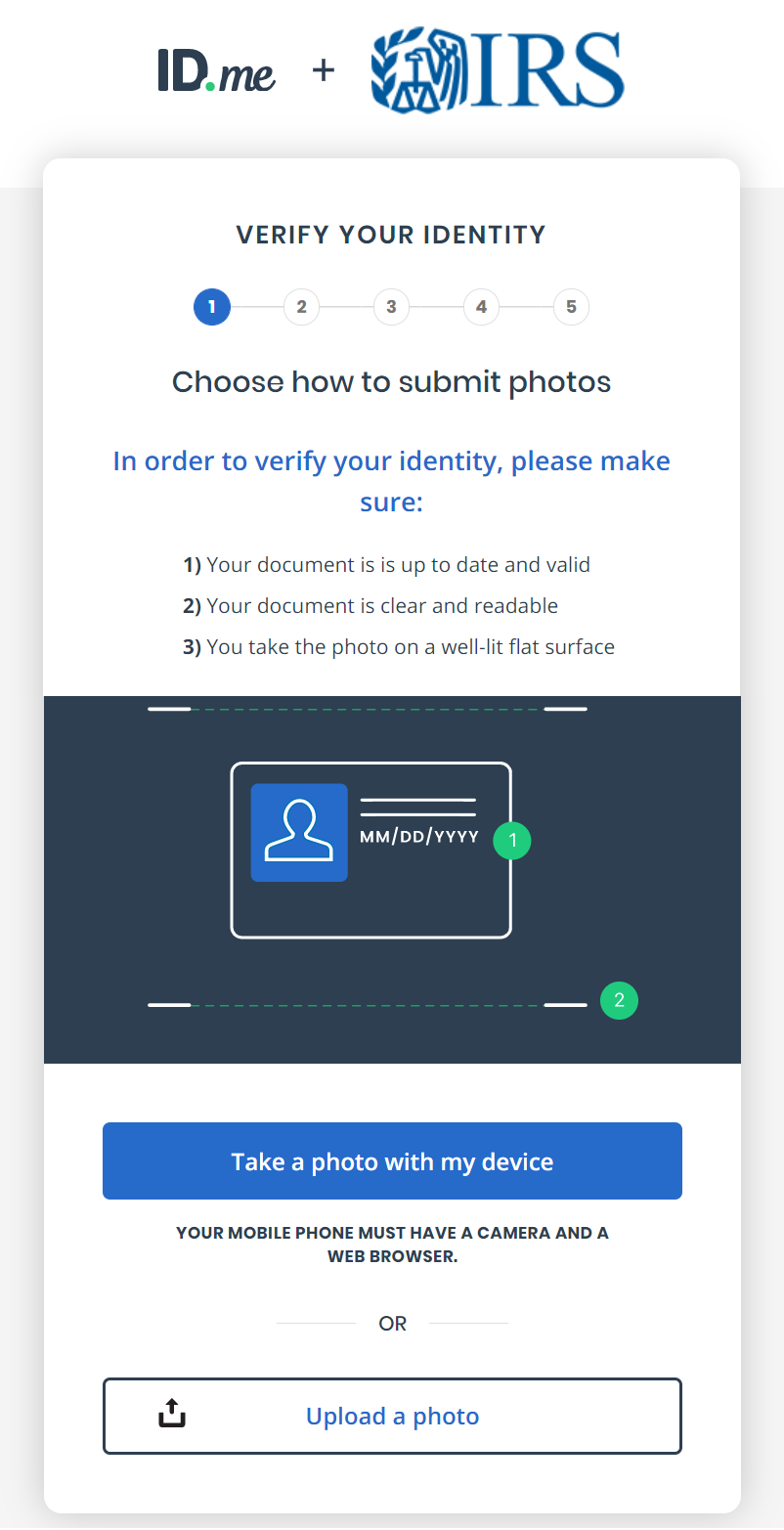

Creating an account to access the Child Tax Credit Portal. Creating an account for the CTC UP portal takes 20-30 minutes to complete if you have everything listed below.

Advancements In The Child Tax Credits Quality Back Office

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Chase On Twitter This Is The Future That I Ve Been Fearing I M Trying To Get Access To The Irs Child Tax Credit Portal And They Want To Verify I M Human By Using

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Families Can Now Register For Child Tax Credit Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

New Child Tax Credit Portal For Qualifying Tax Payers

The Child Tax Credit Portal Is Open Here S What You Should Know

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Opens Non Filer Portal For Child Tax Credit Registration

How To Opt Out Of Child Tax Credit Checks New Update Portal Youtube

I Got My Refund Ctc Portal Updated With Payments Facebook

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Taxpayer Advocate On Twitter If You Ve Moved Update Your Address By Midnight Eastern Time On October 4th To Change Your Mailing Address For Your October Advance Child Tax Credit Payment Use The